Simplified Tax Deduction Guide for Gluten-Free Families

If you thought for a minute that our incredible G-Free Foodie, K.C. Pomering was only good for tantalizing recipes and amazing dietary advice, think again. Turns out her insider knowledge of the gluten-free lifestyle may turn out to be a huge help during tax time!

Did you know that those who have Celiac Disease or an official medical recommendation to live gluten-free may be able to deduct the extra expenses related to their restricted diets? If your total medical expenses for the year exceed 10% (formerly 7.5%) of your adjusted gross income, you may be able to deduct the difference in cost between “regular” food products and gluten-free alternatives.

When looking at total medical expenses, be sure to include doctor and Rx co-pays, insurance, dental, and other expenses that could be used. In other words, be sure to consult a tax professional about your deductions for Celiac Disease costs and write-offs for a gluten-free diet or you may be missing out.

Thanks to K.C., we’ve got a summary of GF tax time tips from National Foundation for Celiac Awareness:

Step 1: Get A Doctor’s Note

Request an official, written Celiac diagnosis or other special diet reccomendation from your doctor.

Submit this documentation with your other completed forms (see Step 4). Make sure to keep a copy for your records!

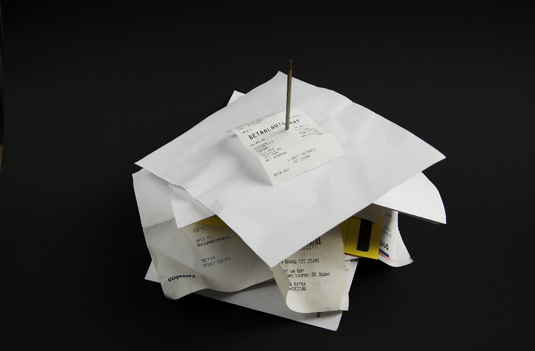

Step 2: Save Your Receipts

Keep receipts of all gluten-free purchases from grocery stores, bakeries and anywhere else you buy gluten-free items.

Step 3: Break Out the Calculator

List the prices of gluten-free foods compared to those of regular foods. The difference between those prices is tax-deductible. For example, if a pound of wheat flour costs $0.89 and a pound of rice flour costs $3.25, then you may deduct $2.36 for each pound of rice flour purchased.

Products like xanthan gum and sorghum flour are completely tax-deductible as they have no “regular” counterpart but are purchased to meet your dietary needs. Shipping costs for online purchases are also permissible deductions.

Step 4: File Your Claim

Fill out form 1040 schedule A for medical deductions.

Refer to:

- IRS Publication 502

- Revenue Rulings: 55-261, 76-80, 2002-19 and 67 TC 481

- Cohen 38 TC 387

- Flemming TC MEMO 1980 583

- Van Kalb TC MEMO 1978 366

Feel free to cite these references in your tax paperwork. For specific circumstances, contact an accountant or tax professional.

One Response to “Simplified Tax Deduction Guide for Gluten-Free Families”

Seriously, has anyone else actually tried this? Has anyone else ever taken this deduction? I have heard it’s “available” if you qualify, but I doubt anyone has ever qualified. Not even once solely on gluten-free food costs.

LikeLike